Sponsored

MilSpouses are nothing if not resourceful. With summer coming to a close and back-to-school and work looming, it’s time to get organized and prepare to tackle some projects around the house before the structured schedules begin again.

But money doesn’t grow on trees. What are the options to get the funds needed to fuel your goals as fall approaches? AAFMAA not only understands the military lifestyle, we’re living it right alongside you — and we can make it even easier than you think.

AAFMAA offers a $5,000 CAP Loan that lets MilSpouses take control and keep their family finances on track. It’s reliable, affordable, and able to help Active Duty military families achieve that secure financial future we all strive for. With a host of other benefits, you won’t get from any other financial solution, it’s our way of continuing to thank you for being part of our AAFMAA family.

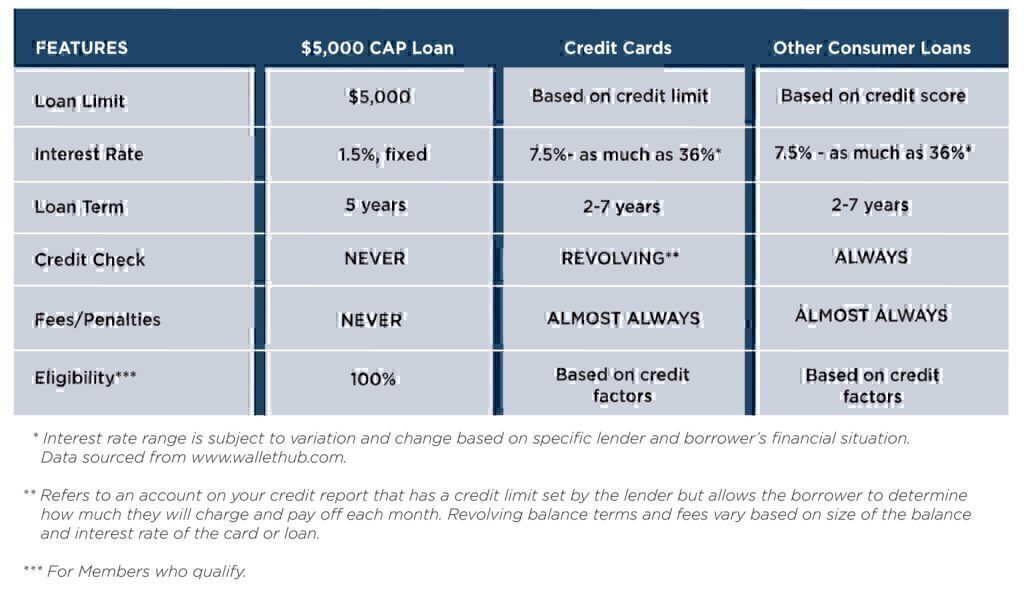

Here’s how our $5,000 CAP Loan stacks up against other options, such as credit cards and other consumer loans:

If you’d like to hear more, check out this video on the $5,000 CAP Loan from AAFMAA’s Chief Operating Officer, Carlos Perez. He discusses how you can use the loan any way you want, with a low 1.5% APR and 5 years to pay it back. There’s no credit check, no collateral required, and no prepayment penalties — making it simple to apply and get started on checking off your summer goals.

Whatever the season has in store, we at AAFMAA are here to help you make it fun, affordable, and part of your ongoing plans for a secure financial future.

Ready to get started? Visit us online at www.aafmaa.com/cap or call us at (800) 991-0268 with your servicemember spouse to start their application for AAFMAA’s $5,000 CAP Loan today.