There are good debts — money prudently spent on items such as an education or a roof over your head — but the best debts are those you can speak of in the past tense. That’s particularly true of credit card debt.

Unfortunately, many people carry month-to-month balances on their credit card accounts.

Those can be crushing sources of stress — financial and otherwise.

Estimates abound for how much credit card debt the average American carries, but the number that matters is your number. Let’s just say it’s $5,000.

Here’s a five point plan to crush that $5,000 of debt over the next 12 months.

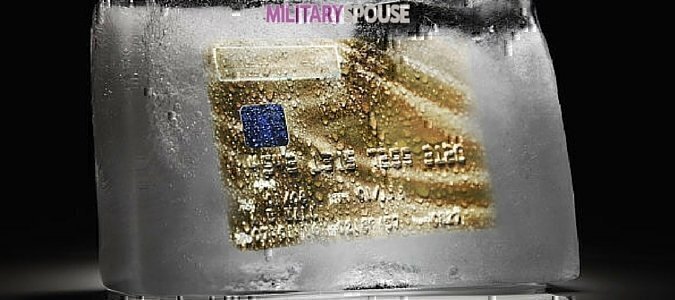

1. Freeze your credit use

If not easy, this is simple: just don’t use it. Struggling? Put your cards in a bowl of water and really freeze them. No matter how you do it, the first step is to stop adding to the problem.

2. Develop a spending plan

If you only make the minimum payments over the course of the year, you’ll end up about where you started. That means you need to free up or find money so you can increase those payments. To be specific, if you want to pay off your debt in a year, you’ll need to come up with $350 or $400 a month above your minimum payment(s). Scrutinize where your money goes and find ways to cut back or cut out expenditures. Canceling the cable, eating out less or clipping coupons are all changes that can help.

3. Create a safety net

If you haven’t already, set aside $1,000 in a savings account before you start to go full force at your debt. You might ask, “Wouldn’t it make more sense to use the $1,000 to pay off debt?” Nope. Having a cash cushion will help ensure you don’t have to use credit if you have a financial emergency. Getting rid of debt is all about habits and this step will help you kick the credit card habit. Consider selling some stuff or using money found during step two to come up with that $1,000.

4. Execute the plan to kill your debt

This is your road map out of debt. If you’ve got one credit card, your path is simple. Simply apply all the extra monthly cash in your new spending plan toward that credit card until it’s paid off. If you’ve got more than one card start by paying as much as you can on the card with the highest interest rate and minimum payments on the rest. When that card is paid down, work on the next one. The linchpin of your success will be developing a spending plan and supersizing your payments.

5. Don’t pay more interest than necessary

Call your credit card(s) company and request a lower interest rate. It could also make sense to consolidate your credit cards into a single zero or low interest rate card or consolidation loan. Remember, though, consolidation alone doesn’t solve the problem.

One more consideration: During next 12 months, be on the lookout for windfalls that could help knock out your credit card debt. If you get a tax return, a bonus at work or an inheritance, make the most of it by paying down your debt.

However you do it, saying goodbye to your credit card debt may rank as your biggest accomplishment of the year.

Read how one military family saved enough money to buy a house…with CASH.