Are you thinking of declaring bankruptcy? You are not alone. An alarming rate of active duty personnel file for bankruptcy each year.

The numbers don’t lie. Filing for bankruptcy doesn’t just happen, it is common among military members and families. There are many factors that lead someone to want to file for bankruptcy. Medical expenses, divorce, credit debt, change in income, and unforeseen hardships are some of the leading instigators for filing for bankruptcy. It is important to understand that there are serious negative side-effects of filing, such as future difficulties with credit, interest rates, security clearance, and getting loans.

It is also important to understand that declaring bankruptcy does not give you a clean slate on current loans, child support, and taxes. If you do decide to file though, it is highly recommended to reach out to a credit counselor first for alternative options or to seek the assistance from the services that are there to help you through the process such as The Defense Finance and Accounting Service.

Again, if you are thinking of, or are about to file for bankruptcy, you are not alone. What can set you apart though, is going about it in the best way possible.

Seeking assistance and help can prevent adding more logs to the fire. Bankruptcy is a tool, not a final word, and using it correctly can be for your benefit. There are both positive and negative outcomes and weighing both sides is crucial. Seeking professional advice and all resources available will assist you and your family to making the best decision for you. Many who have filed for bankruptcy will tell you to exhaust every other option before filing.

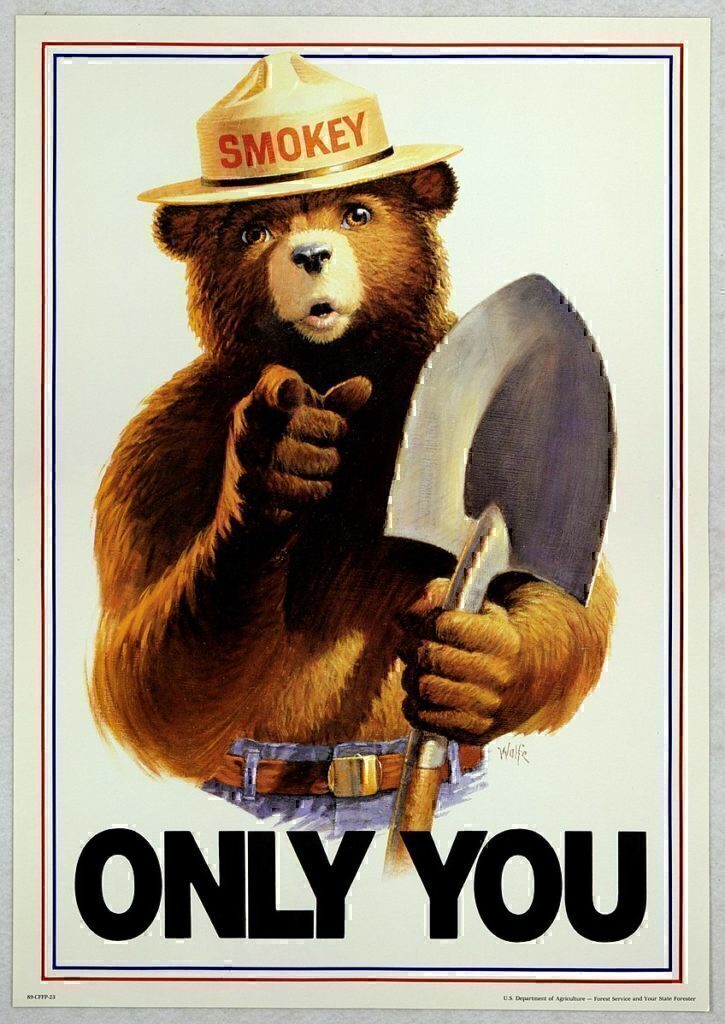

No-one wanted that fire to be started and everyone wants it to be put out. They didn’t see it coming, but it is burning nonetheless. Bankruptcy is like the giant hose to put it out, but there will be coals and debris left behind to clean up. According to Smokey the Bear,

“Only you can prevent Finance Fires!”

One of the best ways to avoid forest fires is prevention. The same goes for financial fires.

Don’t play with fire:

Live below your means. Banks can easily tell you that your family can afford a house worth $50k more than you actually should. Friends and fellow coworkers will own vehicles that should be far out of your price range. Living below your means is not being cheap or weak, it is being smart. Preemptive spending is also a dangerous game. Debt creeps up fast and the best way to avoid that fire is to put the matches down. Spending only what you have and should afford is one way to avoid that finance fire.

Set up fire barriers:

Prepare for the unexpected. There are a multitude of events that could happen that you would not expect. They usually happen at the worst time. They range from anything from a flat tire, to divorce, to a medical diagnoses that no-one saw coming. Life is not a highway. It is filled with turns, mountain climbs, speed-bumps, and tunnels. Therefore we must prepare for them. Setting aside funds or budgeting for those unexpected turn of events will prepare you for those trying times and you will surely be thankful that you did.

Watch that campfire:

Every month the goal should be to see your bank account rising. If you are budgeting to stay on the same line, than there is no room left for growth. Taking a deeper look into expenditures and drawing out exactly what is coming in and what is going out every month is the first step into seeing where there is room for improvement. Even the slightest of tweaks in the right direction will accrue over time and keep that account slowly rising.

Bankruptcy has saved many families. It should not be seen as a negative thing or a place of judgement. What it is though, is a reminder and a flag waving in the sky that the forest is getting dry, the sun is hot, and future prevention measures should be taken.